Blog > September 2024 - Kelowna Real Estate Market Stats

Single Family Homes

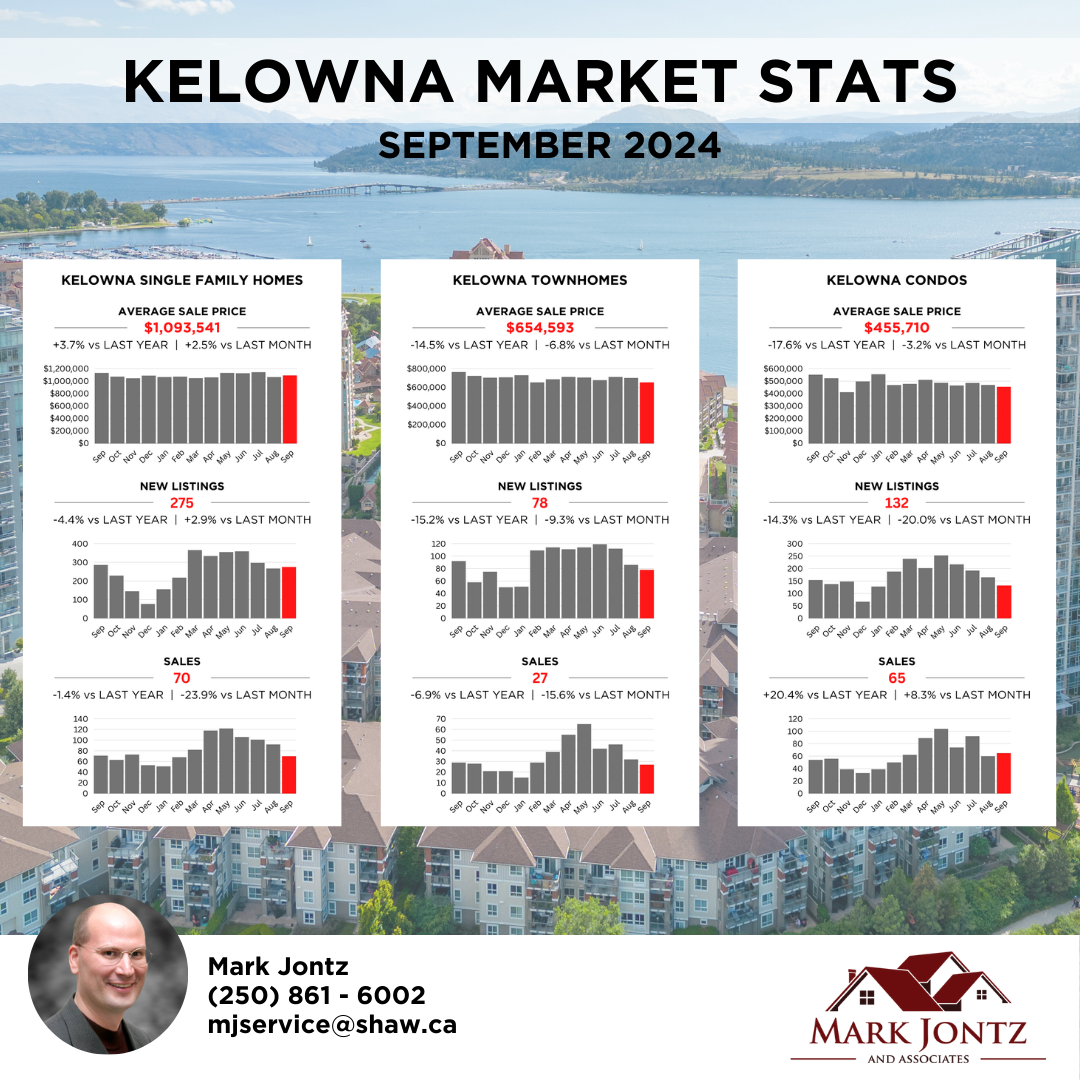

Although sales have declined, the average price of a single family home in Kelowna has remained fairly steady at $1,093,541 for the month of September. It seems that the higher priced homes are sitting while the lower priced homes are selling. Currently we have 15 months of inventory in the single family market, leaning towards a heavy buyer’s market.

Townhomes

Townhomes have dipped in price. Currently the average price of a townhome in Kelowna is $654,593 - down 6.8% from last month and down 14.5% from the same month last year. Currently we have 10 months of inventory in the townhome market.

Condos

The average price of a condo in Kelowna currently sits at $455,710. We are seeing that the newer and higher priced condos are sitting on the market, however the moderately priced condos are selling. Notably, the new builds and concrete-built towers are not getting the price they’re asking as buyers are opting for older condos with more space and a lower cost per square foot. There is just 8 months of inventory in the condo market.

Interest Rates

The Bank of Canada rate was lowered to 4.25% - This is the third consecutive rate drop since June of this year, and more expected to come. The next interest rate announcement date is set at October 23, 2024 along with the BoC’s quarterly Monetary Policy Report. Although variable rates are dropping, they are still much higher than fixed rates, which is why we are not seeing an immediate uptick in the real estate market. The BoC rate affects the variable rate but does not directly change the fixed rates, which are more closely tied to bond markets and other economic factors. Consumer level variable rates are currently at around 6% while fixed term mortgages are in the mid-high 4% range.