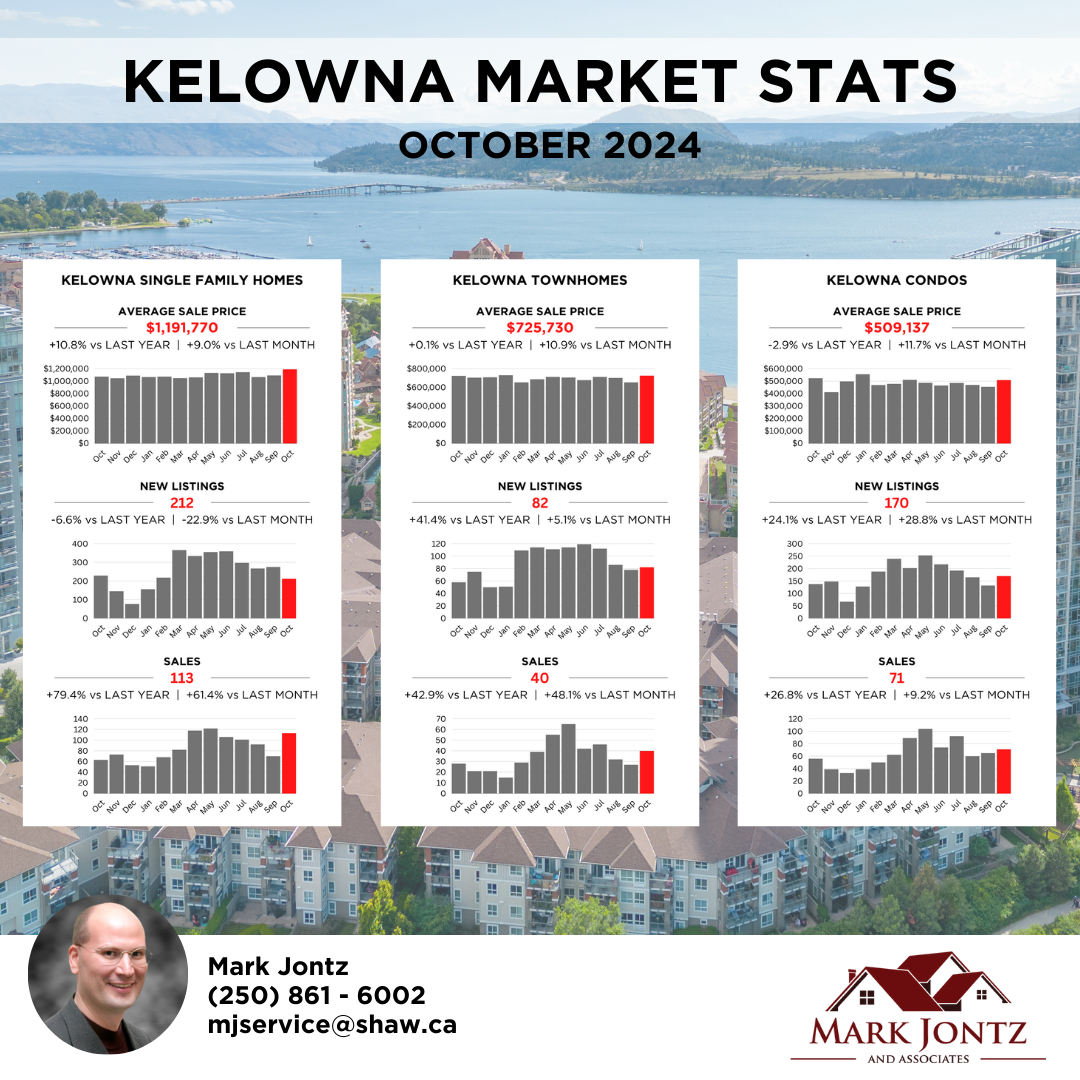

October 2024 - Kelowna Real Estate Market Stats

October typically sees a slowdown as we move into the winter months, but this year has been an exception, with activity picking up significantly.

Notably, there were 10 vacant lot sales, which is unusually high for this time of year. This suggests that home builders are gaining confidence in t

BoC Cuts Interest Rates By 0.5% To Stimulate Economic Growth

On Wednesday, the Bank of Canada announced a 0.5% (50 basis points) reduction in its policy rate, bringing the overnight interest rate down to 3.75%. With inflation now below the target of 2%—currently at 1.6% as of September—the Bank aims to invigorate the economy. Governor Tiff Macklem emphasized

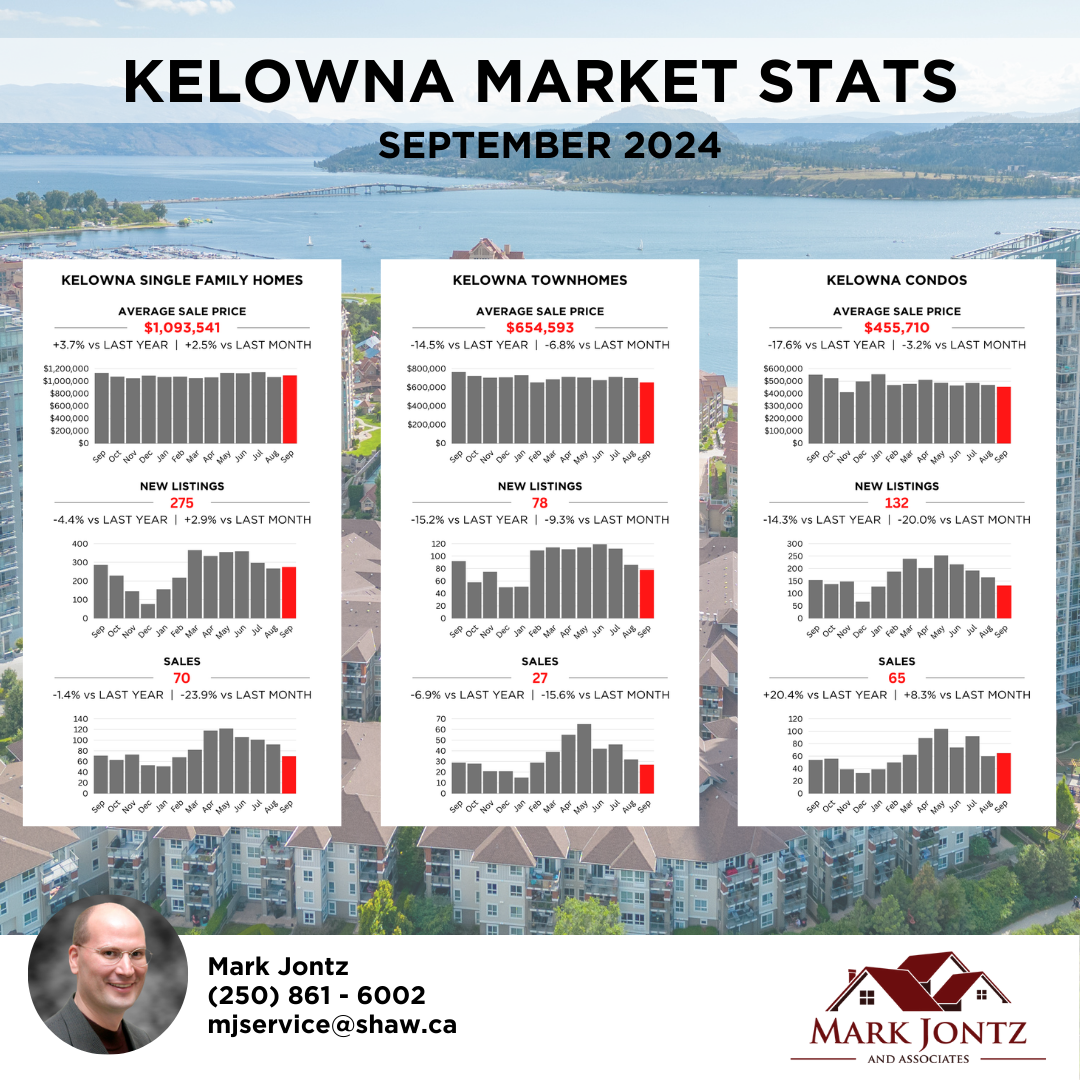

September 2024 - Kelowna Real Estate Market Stats

Single Family Homes

Although sales have declined, the average price of a single family home in Kelowna has remained fairly steady at $1,093,541 for the month of September. It seems that the higher priced homes are sitting while the lower priced homes are selling. Currently we have 15 months of inv

Mark Jontz

Phone:+1(250) 861-6002