British Columbia Introduces 3 Day "Cooling Off" Period

The British Columbia provincial government has introduced a home buyer's protection bill that will allow a 3-day “cooling off” period from the time they have an accepted offer.

Buyers have been pressured to buy properties without proper conditions, or "subject clauses", due to heavy competition which is leaving them with costly problems and repairs after the deal has closed

The mandatory 3-day cooling off period will give home buyers the time to arrange financing, properly inspect the home, and back out of the agreement if they change their mind within 3 days of having their offer accepted. It also provides a cancellation fee of 0.25% of the accepted purchase price if the buyer exercises their right to back out. For example, if a homebuyer exercises the right to recession on a $1 Million dollar home the fee would equate to $2,500 paid directly to the home seller.

The 3 day cooling off period will come into effect January 2023

This legislation was originally announced at the peak of a red hot real estate market, right when real estate sales started to decline. Since March 2022, when this bill was first announced, sales have slowed considerably and we are not seeing the multiple offers that we were seeing in the years prior. Whether this cooling off period will be effective now, or if the government waited too long to react is yet to be determined.

In recent months we have headed more into a balanced market and buyers are now able to put conditions into their offers without having to worry about other competing offers. Sellers are now willing to accept offers with financing, home inspection, and many other conditions. As we've stated earlier this year, if the government is going to introduce this type of rule they should be cautious that if the market were to swing the other way it wouldn't leave sellers at an unfair disadvantage.

Another consideration is whether 3 days is long enough to complete a home inspection or to get financing approved. Even with a solid pre-approval it is highly unlikely that a lender will provide approval in just 3 days. Currently we are seeing approvals take at least 5 business days. As for home inspections, finding a home inspector that can be available on less than 24 hours notice and providing a report then have the buyer read over the report and then do some extra due diligence based on what the report shows all within 3 days is a tall order.

The good news is that buyers will still be able to add regular financing and home inspection conditions with the normal 1-2 week periods so they are not rushed. The purpose of this 3-day cooling off period is to protect buyers in a competitive real estate market where they are not able to put necessary conditions. The question is, why enact this now (actually, January of next year) after the market has cooled and not two years ago when it was needed.

Bank of Canada Hikes Rate by 1%

The Bank of Canada increased its key interest rate by a whole percentage point on Wednesday. This is the largest rate hike the country has seen in 24 years and 0.25% higher than what was expected heading into this weekend.

Indicating the governments aggressive approach to tackling rapidly increasing inflation in Canada, which sits at a 39-year high of 7.7%, we should expect to see some more increases in the future.

This rate hike will impact mortgages as lenders are usually quick to follow with similar rate hikes matching the BoC rate.

The BoC kept rates low during the pandemic in an effort to fuel the economy and keep things afloat while businesses were shut down. With historically low lending rates we saw the housing market skyrocket and inflation grew at an unsustainable pace. Lending rates were kept low even while the housing market was ramping up.

With the average home price in Canada now averaging over $700,000, and the average price in Vancouver and Toronto both averaging over $1 Million, the government and central bank have taken the position to step in and cool things off. The liberal government announced that they would be putting a ban on foreign home buyers for the next two years, and now with interest rates increasing we are definitely seeing the effect on the real estate market.

Home sales have slowed down as first time home buyers are priced out of the market with a lowered qualifying loan amount and some are just waiting on the sidelines to see what happens over the next few months.

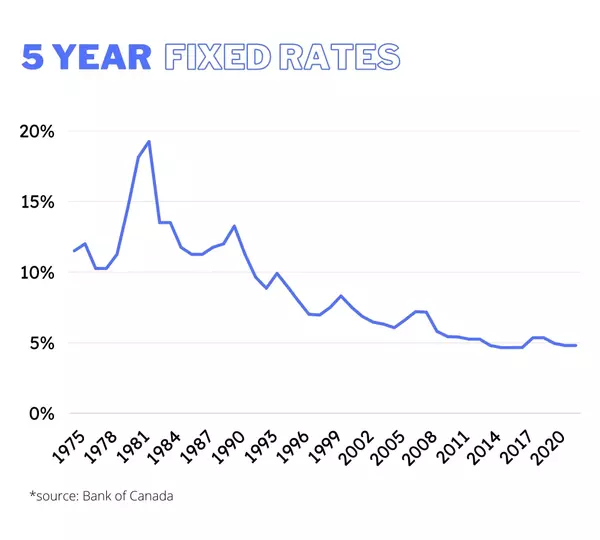

The current interest rates are low compared to historical rates posted by the Bank of Canada. In recent years the 5 year fixed rate has hovered around 5 - 6%. In 2018 the government introduced a stress test to make sure homeowners could qualify if their interest rate increased. The stress test requires the borrower to qualify for the current rate plus 2% but allows them to borrow at the current interest rate.

While we've seen home sales slow down, it has mostly been government policy incduced in order to cool the red hot market that was created with near zero percent interest rates.

Canada To Ban Foreign Home Buyers For Two Years

During a federal budget presentation this week, Canadian finance minister Chrystia Freeland announced a proposal to ban foreign buyers and non-Canadian companies from purchasing residential real estate in Canada for two years.

Home values across Canada have soared more than 50% since 2020 and foreign investment has played a role in this surge of home prices. Homes in Kelowna have increased 32% in just the past 12 months alone.

In 2016 British Columbia introduced a foreign buyer tax, which was originally set at 15% of the fair market value. The tax has since been increased to 20% in an effort to cool the housing market due to foreign investment in Vancouver, Kelowna, and other areas of BC. The foreign buyer tax seemed to slow the market down when it was implemented in 2016 at a 15% tax rate and then raised to a 20% tax rate in 2018.

Some buyers will be exempt from the new foreign buyer ban including students, refugees, foreign workers, and permanent residents. Some industry experts have raised concerns about whether the foreign buyer ban violates the US-Canada-Mexico Trade Agreement and other international trade agreements by discriminating based on nationallity. Others have pointed out that most international investment is done through friends and family members who are exempt from any taxes or bans.

Some have argued that this may not have much of an effect on prices as the vast majority of investment is coming from Canadian investors and landlords buying multiple properties to rent out. It will be interesting to see how this plays out.

Billions Of Dollars Towards Creating More Housing Supply

Also announced was a plan to provide billions of dollars to increase new home construction in order to increase supply to match the demand for new housing. More inventory would hopefully curb further inflation of the housing market.

Several billion dollars will be allocated to building affordable housing and to helping local governments and municipalities update their building permit systems to allow faster construction of new homes. Some argue that the price surge in Canada is due to a fundamental lack of supply and this should help that problem. There still remains the issue of increased cost of supplies for building so it is unclear whether it will reduce the prices of new home builds, but it should relieve some pressure on resale homes.

Possible Ban On Blind Bidding

Discussions have also been brewing about banning the closed bidding process in Canada. The current bidding system leaves buyers out of the loop regarding the price of competing offers. This is believed to have caused an increase in the rate of inflation of house prices as many buyers are making significantly higher offers without knowing how high they need to go. Some homes have sold for hundreds of thousands of dollars over their list price.

Also in the budget proposal is a program for a tax-free savings account for first-time home buyers.

Mark Jontz

Phone:+1(250) 861-6002